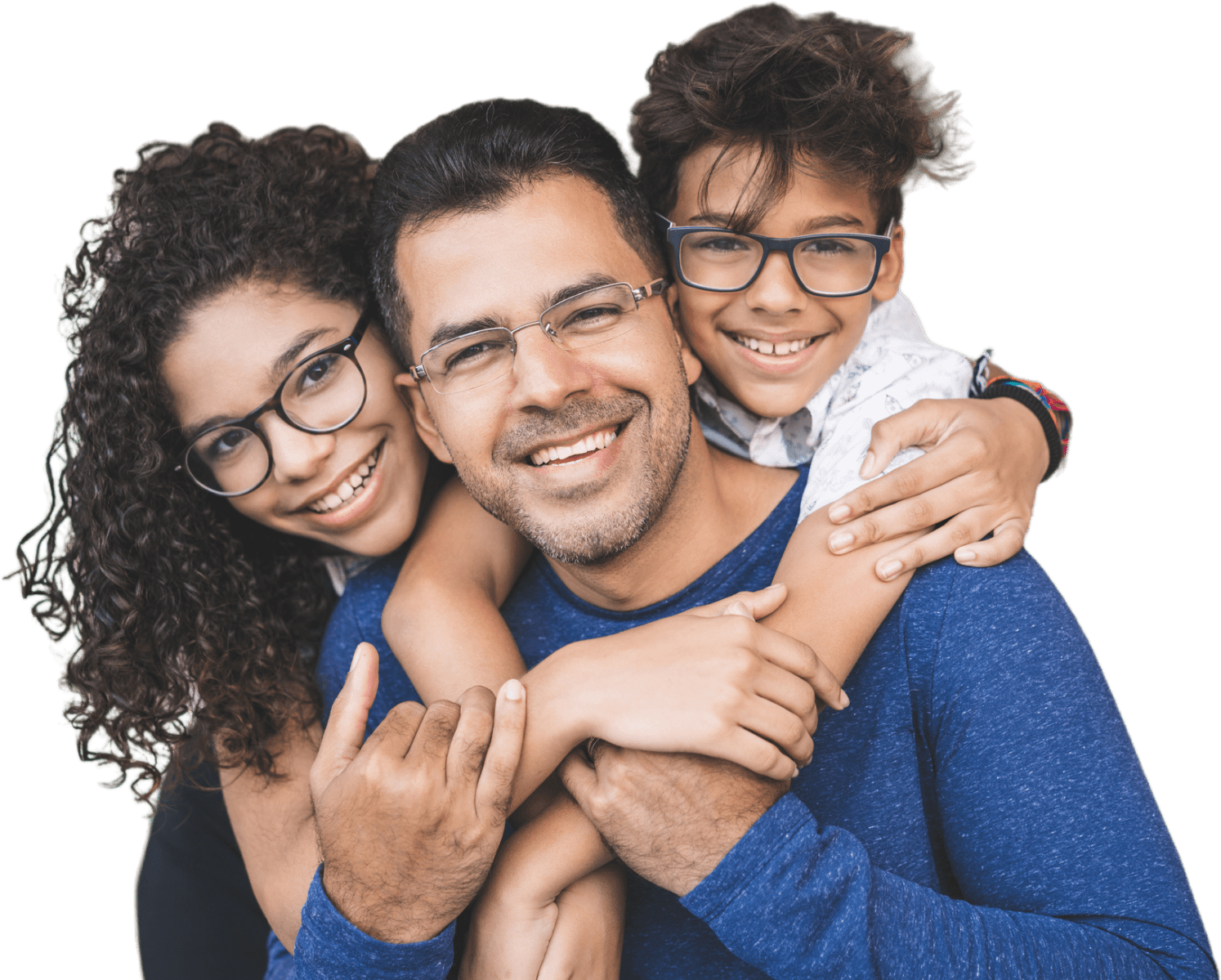

Your home may be the most valuable investment in your and your family's future and it's among the most important reasons why Canadians buy life insurance.

With mortgage being one of the largest debts for Canadians, Mortgage Life Insurance can help your loved ones cover this financial liability if you are no longer there.

What set our plans apart from your lender’s

mortgage insurance

You own the policy

You own your policy in full, with the benefits payable to the beneficiary of your choice. With lender’s mortgage insurance the benefit is paid to your bank and protects their interests and not yours.

Level coverage

Your coverage stays the same through the duration of your policy, unlike lender’s insurance, which decreases with balance of your mortgage.

Coverage that moves with you

If you decide to move or sell your home your coverage stays intact, unlike lender’s insurance.

Protected even when mortgage is paid off

Depending on the term of your policy you are still protected even when the mortgage is paid off, which is terminated with lender’s insurance.

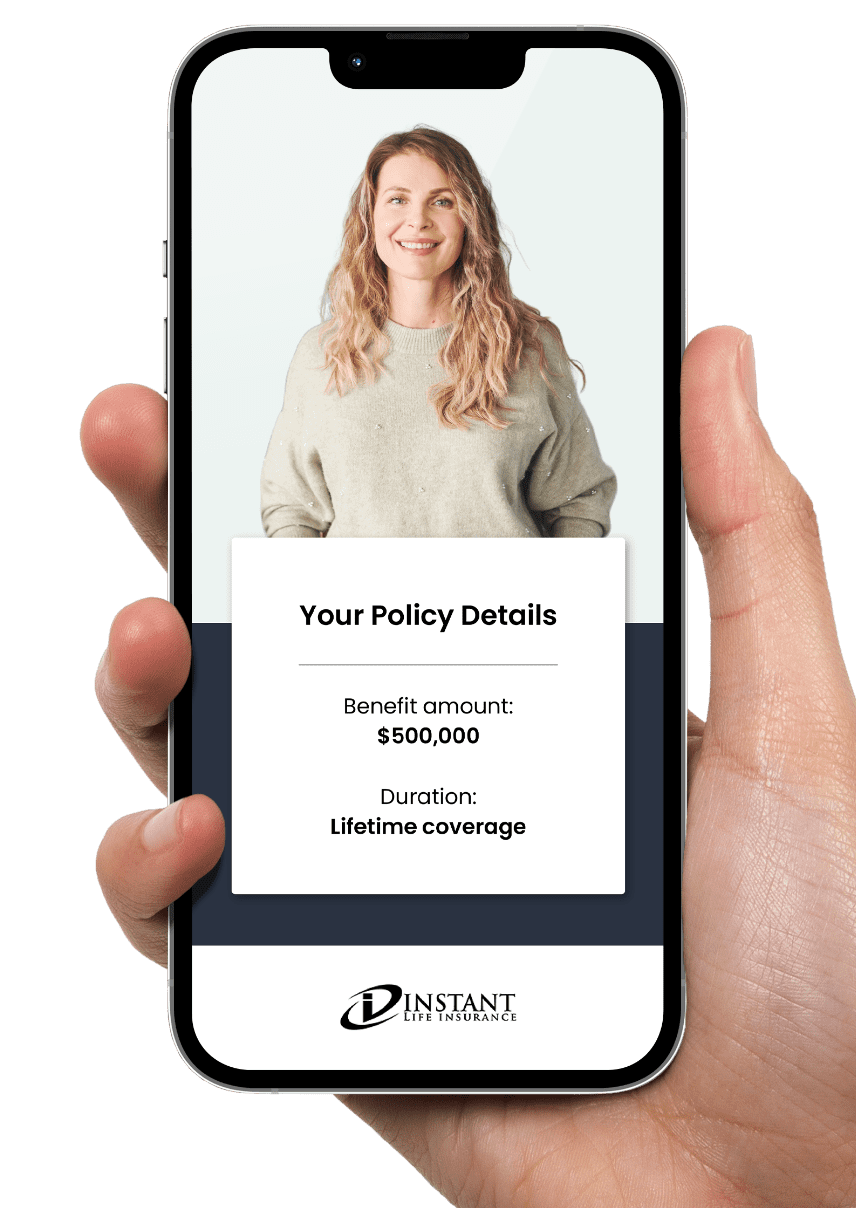

Features of our plans at glance

Fast Coverage up to $500,000

Eligibility age is 18 to 80

Choice of duration for coverage for 10 or 20 years

Premiums guaranteed to stay fixed for duration of the policy

At the end of the term the plan can renewed or converted to permanent policy with no medical exam or additional health questions

Mortgage Life Insurance: important questions you are asking

What is Mortgage Life Insurance?

Mortgage Life Insurance is a life insurance policy that can help your beneficiaries cover the mortgage balance on your home if you pass away.

Who is eligible?

Ages 18 to 80

Canadian citizen or permanent resident

Premiums

Could I qualify for preferred Mortgage Life Insurance rates?

The rates will depend on several factors such as coverage amount and duration, age, gender, smoking status and health status. Typically individual in good health are able to secure a preferred rate.

Are the rates guaranteed for Mortgage Life Insurance?

Yes! Your rates are guaranteed to stay level throughout the duration of your policy.

How long will I pay premiums for Mortgage Life Insurance?

We have 2 terms available: 10 years or 20 years, depending on how you want your coverage to last.

What happens to my Mortgage Life Insurance premiums if I quit smoking after my policy is issued?

If you have been nicotine free for at least 12 months you can reapply for non-smoker rates in order to reduce your premium payments.

How do I pay for my Mortgage Life Insurance policy?

The payments can be made by credit card or direct debit on a monthly or yearly basis.

Applying for Coverage

How do I apply for Mortgage Life Insurance?

It's easy to get started, just apply for a free quote on our website. You will be connected with our licensed advisor who will provide your personal quote and answer any questions you may have. The application can be completed right over the phone and your policy issued shortly after via email.

If I smoke, can I apply for Mortgage Life Insurance?

Yes you can apply for Mortgage Life Insurance if you are a smoker; however, this will have an affect on your rate.

Can I cancel my Mortgage Life Insurance policy at any time?

The policy can be cancelled at any time, with a full refund if you changed your mind within 10 days from the effective date.

Coverage Details

When does coverage start and end for Mortgage Life Insurance?

Your coverage start from your chosen effective date and will last the duration you have chosen either 10 or 20 years. At the end of this coverage period (term), you have the option to renew or convert to a permanent policy without any additional medicals or questions asked.

Can I reduce or increase my Mortgage Life Insurance coverage?

You can decrease your coverage as your needs change; however, in order to increase coverage another policy would need to be obtained.

Is there any cash value with a Mortgage Life Insurance policy?

There is no cash value to Mortgage Life Insurance, which makes it a more affordable option compared to policies that offer cash value.